According to Sea-Intelligence, the COVID-19 pandemic has resulted in a decrease in the total number of port-pair linkages on the Europe-North America East Coast (NAEC) commerce.

Sea-Intelligence’s analysis witnessed the overall number of port-pair connections remained reasonably consistent in the first half of 2019, staying around 600-800 connections.

However, the pandemic appears to have had the greatest impact on NEUR-NAEC, since the overall number of connections decreased dramatically before returning to pre-pandemic levels in 2023.

MED-NAEC did not show the similar reduction, and there is a significant level shift in favour of MED-NAEC after the pandemic, with the post-pandemic value somewhat higher than the pre-pandemic baseline.

READ: Managing risks from potential East Coast port strikes

The pandemic accelerated the pre-pandemic growing trend for MED-NAEC in terms of unique connections (where one port-pair connection is counted once and is unaffected by the number of times that connection is made/called).

In 2023, Sea-Intelligence revealed that different connections on MED-NAEC climbed by 26 per cent compared to the same time period in 2019, while NEUR-NAEC increased by 18 per cent.

READ: North America’s East Coast laden imports pick up pace

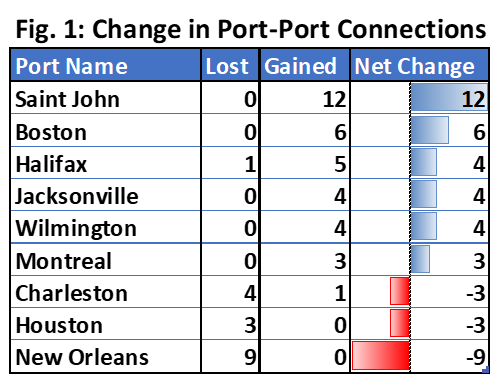

Figure 1 outlines the most significant positive and negative trends in direct port-pair connectivity between Europe and North America’s East Coast.

Even while different port-pair connections grew for both trades compared to pre-pandemic levels, the growth was not similar.

Alan Murphy, CEO of Sea-Intelligence, said: “When we compare 2023 to 2019, New Orleans lost nine direct connections to Europe and gained none, effectively cutting it off from any direct services originating in Europe. Saint John on the other hand was the largest beneficiary, gaining 12 direct port-pair connections from Europe, having previously not been connected at all.”