According to Sea-Intelligence, the total and unique port-pair connections on the North America-East Coast South America and West Coast South America trade have fallen dramatically during the last stages of the COVID-19 pandemic.

Sea-Intelligence noted it would have ascribed the decline to blank sailings if the overall port-pair connections had fallen while the unique port-pair connections remained consistent.

However, as both indicators have fallen, Sea-Intelligence revealed that it indicates a mix of pandemic-related blank sailings as well as a convergence of the carriers’ service offerings.

READ: Major carriers’ revenues plunge to pre-pandemic depths in Q3

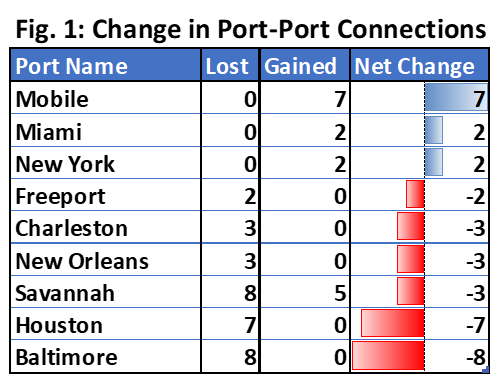

According to Sea-Intelligence, this consolidation resulted in the loss of direct access to South America for numerous US ports. Figure 1 depicts the most significant changes in port-pair connectivity on this trade.

Baltimore lost eight separate port-pair connections, thus cutting it off from the rest of South America.

Houston lost seven separate port-pair links to South America, while Charleston lost three, leaving both ports without direct access to West Coast South America.

Savannah also lost eight separate port-pair connections, thereby cutting off direct connectivity to East Coast South America.

Mobile, on the other hand, received seven port-pair connections and direct access to East Coast South America.

READ: Capacity growth for 2023 remains excessive

Sea-Intelligence noted that this happened at the cost of both Baltimore and Savannah, indicating that carriers are moving part of their attention to the Gulf Coast rather than the North Atlantic.

Alan Murphy, CEO of Sea-Intelligence, stated: “Another observation that we made was that the pandemic impact on North America-South America didn’t really materialise until the second half of 2021, and the connectivity on North America-East Coast South America is still below pre-pandemic levels.”