According to Sea-Intelligence, there has been a significant growth in the demand for recreational goods and services in the maritime industry.

As the usual peak season draws to a close, the spot rate drops over the previous two weeks are a very strong indication that the peak season did not materialise.

Additionally, there are ominous clouds looming over the transpacific commerce that are partly related to US consumer behaviours.

One factor is the shift in consumer behaviour from services to commodities that Sea-Intelligence witnessed during the COVID-19 pandemic, which they believe is likely to happen again and negatively affect import volumes.

READ: Decline in US-Asia imports challenges global container recovery

Sea-Intelligence discovered that the surge in recent months has been centred on products that aren’t often transported in containers. According to the firm, this information was collected from the US BEA (Bureau of Economic Analysis).

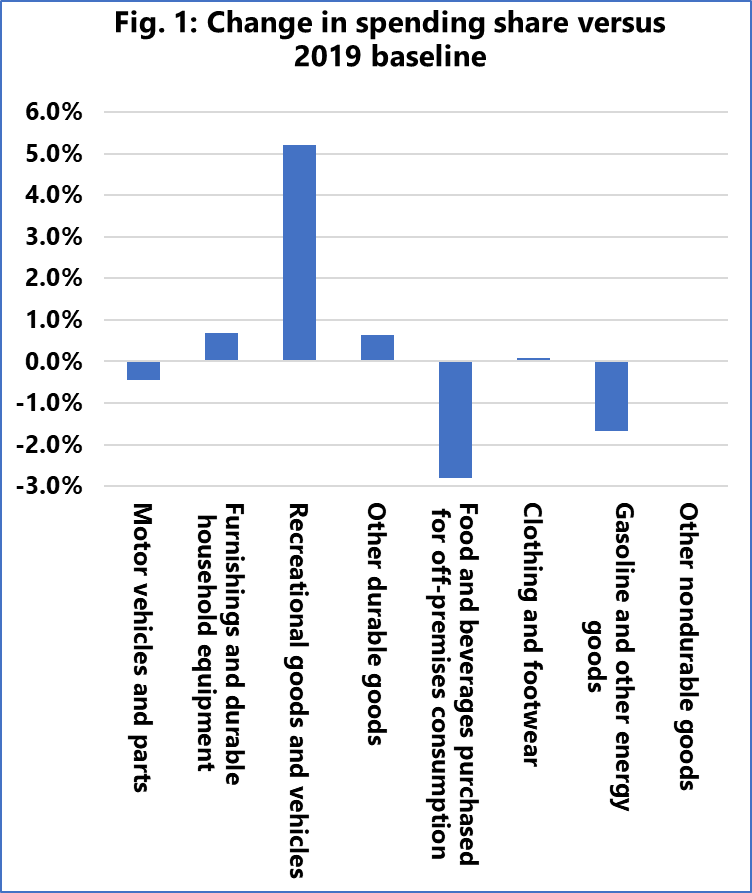

As presented in Figure 1, the largest increase is for recreational goods and services, from 12 per cent of the consumption in 2019 to 17.2 per cent by July 2023.

Additionally, Sea-Intelligence observed that the largest growth within this category is exhibited by ‘Video, Audio, Photographic, Information Processing Equipment, and Media’. Going a step further, the ‘Information Processing Equipment’ is growing quick in mid-2023.

READ: Shipping alliances witness Asia-Europe reliability gains

Alan Murphy, CEO of Sea-Intelligence, said: “The main driver of strong growth within this category is clearly seen to be Computer Software and Accessories; and software is mainly not moving in containers, which means that this strong boost to consumer spending does not benefit container shipping lines.

“Another major growth component on goods spending is the overall ‘Vehicles’ category. New vehicles are indeed growing well, but once again, these are mainly not containerised.”