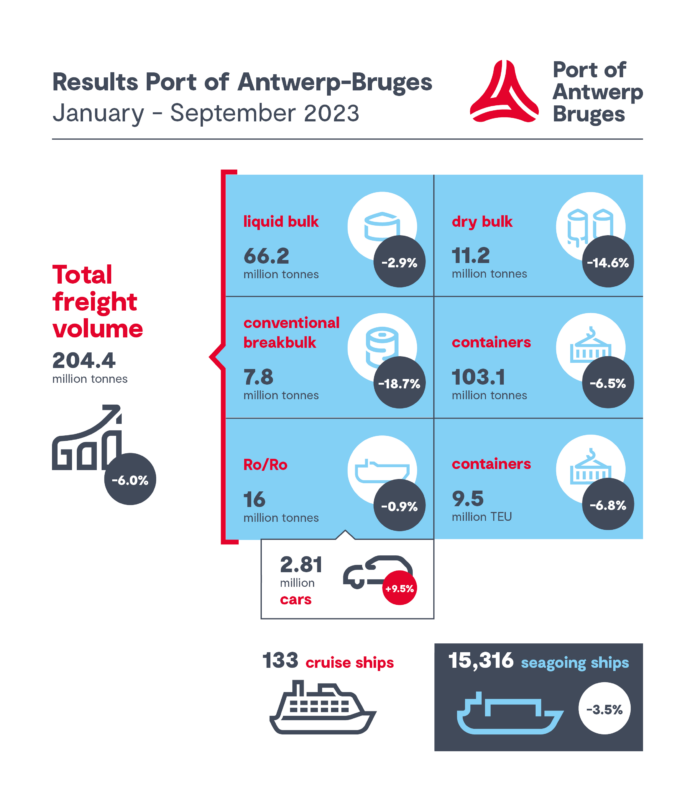

The total throughput of the Port of Antwerp-Bruges has totalled 204.4 million tonnes in the first nine months of the year, a drop of 6 per cent compared to the same period in 2022.

The Port of Antwerp-Bruges has attributed its throughput decline to the volatility of the global economy. This is reflected in the port’s 6.5 per cent drop in container throughput in terms of tonnage, and 6.8 per cent in TEU, compared to the same period in 2022.

Despite the fall in container throughput, the Port of Antwerp-Bruges’ market share in the Hamburg-Le Havre range reportedly increased by 1 per cent point in the first half of this year, to 30.6 per cent.

Despite the bad economic situation, conventional breakbulk is holding up rather well, with throughput levels comparable to the pre-COVID period, the port reported.

Throughput is down 18.6 per cent compared to the same period in 2022, which was defined by a robust post-COVID rebound.

READ: Port of Antwerp-Bruges sees container volume decrease in Q1/Q2 2023

Steel throughput, the largest commodity group within this area, is down 17.6 per cent as a result of a reduction in European steel output and weaker demand, according to Port of Antwerp-Bruges.

Roll-on/roll-off (RoRo) traffic has been constant (0.9 per cent). The throughput of transport equipment increased by 8.9 per cent due to an increase in the throughput of new automobiles (+12.6 per cent) to 2.67 million units.

In addition to delivering equipment, RoRo vessels transported 7 million tonnes of unaccompanied freight (excluding containers) (-1.4 per cent).

The proportion of this cargo associated to Ireland increased by 18.5 per cent, whereas traffic to and from the UK decreased (-3.8 per cent).

READ: Port of Antwerp-Bruges Q1 throughput drops due to economic slowdown

Jacques Vandermeiren, CEO Port of Antwerp-Bruges, said: “The continued economic and geopolitical concerns have been visible in the figures for several quarters now. The competitiveness of European industry is under pressure due to high energy, raw materials and labour costs combined with low global demand.

“The indicators do not yet show any improvement for the near future, and container throughput will still be impacted in Q4 by cancelled voyages from the Far East. Despite the fact that our throughput is falling less than the average in the Hamburg-Le Havre range and we are gaining market share, we will have to face the fact that 2023 will not be a top year.”