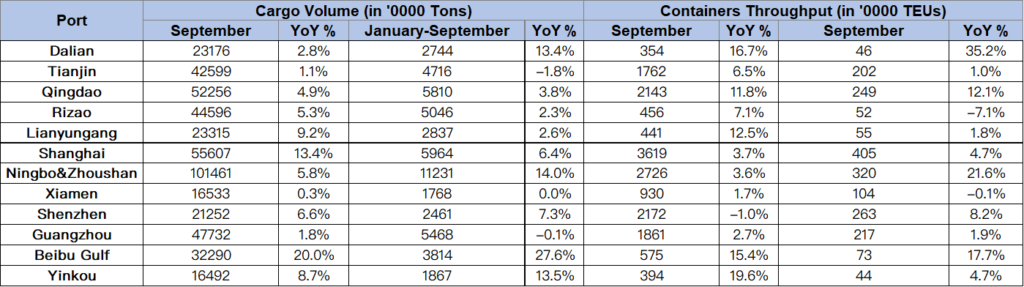

The container throughput of ports in China from January to September hit 230.7 million TEU, a 5.2 per cent rise year-on-year (YoY).

The Port of Shanghai, which recently issued the outline for a Green Shipping Corridor Implementation Plan together with the Ports of Los Angeles and Long Beach, witnessed an increase in container volumes of 4.7 per cent YoY. Last month, the port moved an impressive 4 million TEU; over the course of the first nine months of this year, the port has successfully handled 36.1 million TEU, inching closer to its previous year’s record of 43 million TEU.

The Port of Qingdao also recorded a strong performance witnessing a 12.1 per cent YoY increase, totalling 2.4 million TEU last month.

READ: Qingdao Port becomes the world’s first hydrogen-powered and 5G intelligent port

The Port of Ningbo-Zhoushan also performed well in September, with a 21.6 per cent YoY TEU growth. The port attained a container throughput of 33.35 million TEU in 2022.

*Please note the first column for container throughput statistics refers to the period spanning from January to September

In terms of container freight prices, the Ningbo Container Freight Index (NCFI) averaged 623.1 points in October, a 3.7 per cent fall from the previous month.

In October, shipping demand from Ningbo to the North American market was so low that most carriers were forced to reduce space availability by cancelling some voyages.

The average freight cost of 40GP from Ningbo Port to the Ports of Los Angeles and New York & New Jersey was $1683 (-12.0 per cent) and $2174 (-14.8 per cent) month on month (MoM).

From January to August, the container throughput of Chinese ports hit 203.7 million TEU, a YoY increase of 4.8 per cent.

PTI’s editorial team recently sat down for an interview with Christian Sur, EVP of Ocean Freight and Contract Logistics at Unique Logistics, to discuss China’s current footing in global shipping, and the recent shift of manufacturers to other Southeast Asian countries.