Major shipping lines have posted a combined 2024 FY EBIT of $27.3 billion, according to the latest report from Sea-Intelligence.

In comparison, the cumulative EBIT for 2021 and 2022 was over $200 billion across the same shipping lines. However, profitability in 2024 proved significantly better than in pre-Covid years.

The EBIT reported in 2024-FY exceeds the total EBIT of 2019, 2020, and 2023.

Since the covered shipping lines do not represent the entire market—missing Mediterranean Shipping Company (MSC), PIL, and CMA CGM—Sea-Intelligence was able to estimate total market profitability by applying the average EBIT of disclosed lines to the entire market, based on capacity.

This approach suggests an industry EBIT of $60 billion in 2024.

READ: Volumes transition from the East to West Coast ports in H2 2024

READ: Africa set to become a major global shipping hub

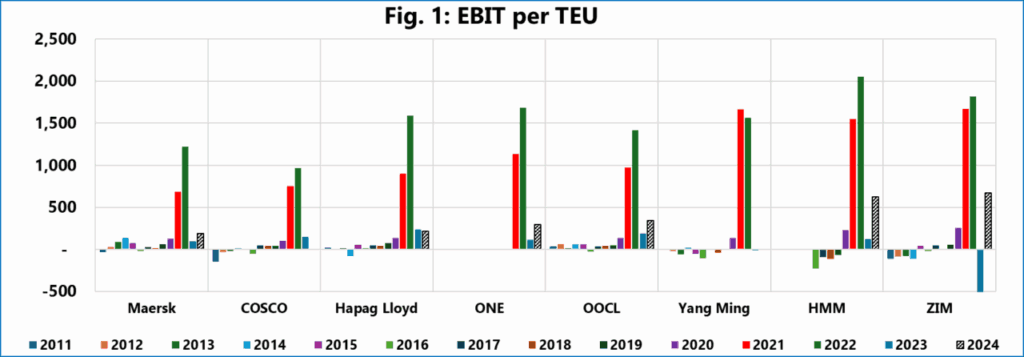

Figure 1 shows the EBIT/TEU for shipping lines reporting both EBIT and global volumes annually.

Maersk’s 192 USD/TEU is lower than 2021-2022 but still above most pre-pandemic years.

ZIM (674 USD/TEU), Hyundai Merchant Marine (HMM) (622 USD/TEU), Hapag-Lloyd (215 USD/TEU), and OOCL (346 USD/TEU) have their highest EBIT/TEU in a decade, excluding 2021-2022.

ONE Line (300 USD/TEU) lacks a pre-pandemic reference.