According to the most recent inventory data from the US Census Bureau, US retailers are continuing to increase stocks beyond what sales can allow.

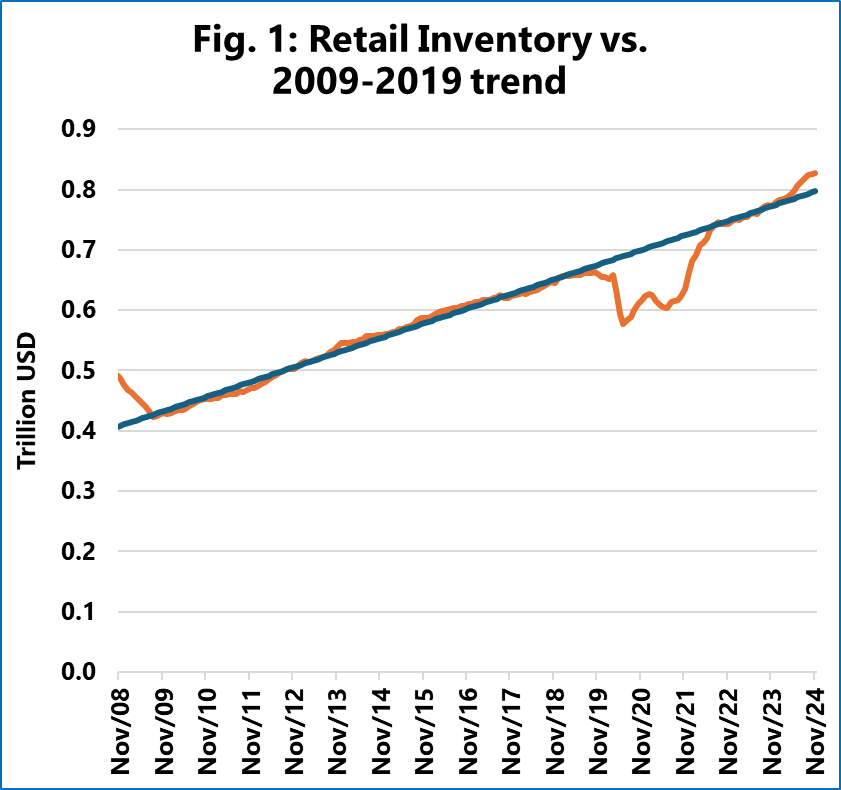

Figure 1 from Sea-Intelligence depicts the size of retail inventories throughout time, as well as a trend line that corresponds to the 2009-2019 period. The orange line showing inventory exceeds the blue trend line.

In absolute terms, the departure reached a point in November 2024 when merchants’ stocks were $30.2 billion greater than what could be accounted for by typical trend growth.

READ: US inventory data provides no hint of spot rate rise

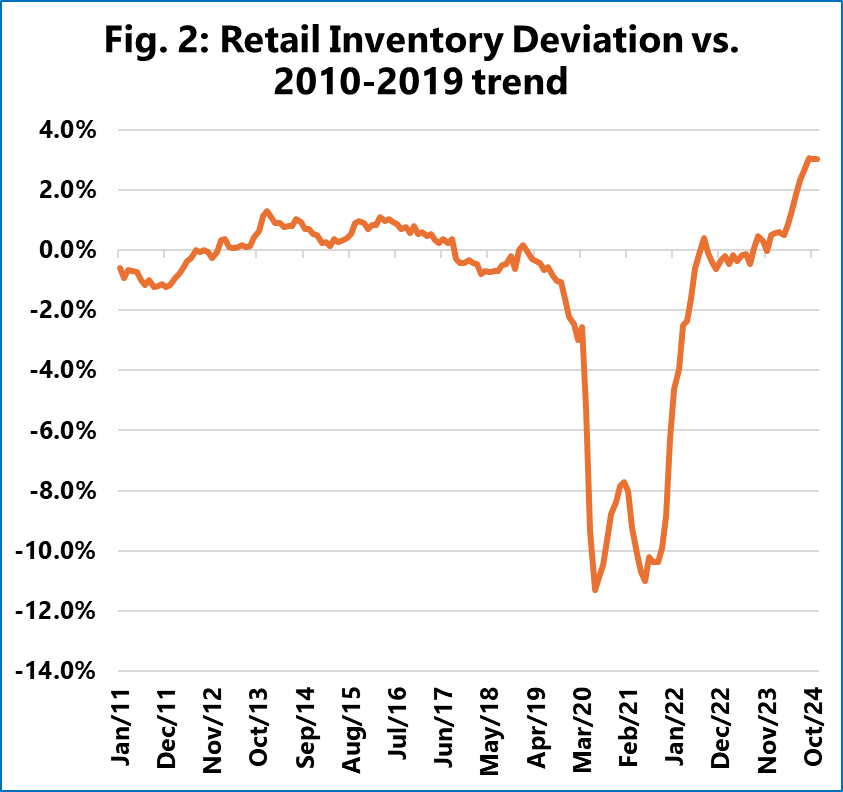

Alan Murphy, CEO of Sea-Intelligence, questioned: “How much have actual retail inventories deviated from the trend line since 2011, when most of the post-financial crisis effects had disappeared?”

This is seen in Figure 2. The upward surge in July-August 2024 is not only noticeable, but it is also the highest upward departure witnessed since the financial crisis.

The highest deviation was seen in September 2024, at 3.1 per cent, although this only slightly decreased to 3.0 per cent in October and November.

READ: US consumer spending shows no sign of sudden surge

As a result, Sea-Intelligence reported that it is correct to claim that merchants are not only raising inventory but doing so at a far faster rate than the long-term trend.

Murphy added: “For some merchants, stockpiling inventory may serve as a hedge against future levies. However, if consumer spending is abruptly curtailed owing to the inflationary effect of tariffs, businesses may find themselves with surplus inventory.”